Market data is from Bloomberg, FactSet and FE Analytics.

After the sharp sell-off in global markets in the first week of August, the UK market has recovered most of its lost ground, now trading back near the all-time high it reached in late July. The Roman emperor and stoic philosopher Marcus Aurelius described the art of living as ‘more like wrestling than dancing’, a sentiment that could be applied to navigating investment markets over the summer and into the autumn, with day-to-day volatility high.

The escalating conflict in the Middle East is currently dominating the news agenda, and the outcome of the impending US presidential election remains too close to call. Set against these risks are some chinks of economic light, however. US economic data has reassured with employment data holding up, and inflation continuing to cool. These developments allowed the Federal Reserve to cut interest rates by 0.5% in September, with further cuts expected over coming months. After the rapid rise in rates during the post-Covid inflationary spike - from near zero to over 5% - this turning point will provide welcome relief to both the US and the rest of the world. Adding to this positive development was the Chinese government’s announcement in the last week of September that it is willing to deploy a variety of fiscal and monetary interventions to help its ailing economy. The shares of companies with exposure to China perked up as a result.

Evenlode Income has risen +5.9% so far this year, compared to a rise of +9.9% for the FTSE All-Share and +9.3% for the IA UK All Companies sector[i]. As discussed in recent investment views, the fund’s 2024 underperformance occurred in March and April, as more cyclical and asset-intensive sectors drove the market higher, leaving the Evenlode Income portfolio behind. The market has broadened out since the end of April, with Evenlode Income outperforming the FTSE All-Share and the IA UK All Companies sector since then.

Though not fashionable at the moment, we continue to pursue our usual investment approach, and have faith in its through-cycle delivery. As highlighted in the chart below, the strategy has returned +336% after fees since launch, versus +183% for the FTSE All-Share Index and 173% for the IA UK All Companies sector, over a period of just under fifteen years[ii].

Past performance is not a reliable guide to future returns.

Quality and long-term value

We’ll use the rest of this investment view to give an update on three companies that highlight some key themes within the portfolio.

Bunzl - Patient compounding and buy-backs

Bunzl is the global market-leading distributor of not-for-resale consumables – providing cleaning items, packaging, protective equipment etc., to a variety of sectors from healthcare to food services. We met with management last month after interim results.

On the face of it, Bunzl might look like a dull business. For patient shareholders though, the company has a strong record of capital allocation and long-term value creation, which has helped drive 31 years of consecutive dividend growth. This performance has been underpinned by the company’s strong competitive position, its close and embedded relationship with customers, and its consistent strategy to invest both organically and via bolt-on acquisitions.

The company typically makes about ten small acquisitions a year, from a large potential pipeline. These are often founder-run companies who view Bunzl as a trusted long-term home for the business they have built. As a result, discussions are not primarily driven by price, with valuation typically in a stable range of 6-8x earnings across the economic cycle. The return on investment generated from this capital deployment has been consistently attractive, with revenue and procurement benefits enhancing profit once each business is brought into the larger group. This self-funded compounding model, supplemented by bolt-on acquisitions at good rates of returns, is reflected in a range of other businesses across the portfolio such as Halma, Diploma, Compass and RELX.

Bunzl’s free cash flow yield[iii] is currently over 6% and the balance sheet is strong. This led management, at recent interim results, to announce – on top of its investment and acquisition plans – a share buy-back of £250m this year, and the likelihood of another £200m for next year. In aggregate this represents approximately 4% of the company’s valuation. This is a theme we have seen across other holdings - with cash generation strong, approximately 60% of the Evenlode Income portfolio by weight is invested in companies that have been ‘eating themselves’ during 2024. For the long-term shareholder, without doing anything, these repurchases quietly increase the economic ownership of each share in a company.

Diageo - A global leader navigating a sector downturn

Diageo has faced a very challenging industry backdrop over the last eighteen months. The company released a trading statement in September, confirming that conditions are unchanged since they last updated the market at the end of July.

We have spoken to several experts in the spirits industry over recent months, to make sure we understand short-term trading dynamics, and to explore the longer-term outlook. Our view is that the sector’s downturn is overwhelmingly a cyclical issue, driven by the hangover from Covid-related behavioural changes (both during the Covid lockdowns and in their immediate aftermath), extraordinary pressure on consumer’s disposable income over the last two years, and the bullwhip effect of the unwinding of the stock levels that built up during the post-Covid inflationary spike. Our sense is that the industry is getting close to the end of inventory adjustments in the US market, with wholesalers and retailers holding considerably less stock that they did a year or two ago. When demand starts to recover, we think Diageo will be well placed to benefit. The company remains a well-invested global market leader with a strong portfolio of brands, a global footprint, and a valuation that hasn’t looked this good for a decade.

Diageo’s industry backdrop highlights a wider trend: though Covid began nearly half a decade ago, the pandemic’s, aftershocks are still washing through the global economy. As well as Diageo, certain holdings in the luxury, recruitment and engineering sectors have been suffering from similar post-Covid related operating headwinds. Their valuations look very interesting as a result.

Spirax Group – And our interest in out-of-fashion compounders

We take a long-term approach with the Evenlode Income fund - holding periods are typically five years or more, and stakes in some companies have been held in the fund since launch in 2009. We expect the bulk of long-term returns to come from compounding per share free cash flows, combined with the dividends that this cash generation helps to pay. We do, though, evolve the portfolio over time – we call it ‘nudging’. This process is partly to manage risk, but also to recycle capital towards areas of the portfolio and investable universe where the combination of quality and valuation looks particularly attractive at any point in time.

The following new positions have been added to the Evenlode Income portfolio since 2022, at times when we have seen an interesting combination of quality and value based on our long-term free cash flow estimates. The figures in brackets detail the total return (in GBP terms) of each stock since the end of the month in which the position was added, versus the UK market[iv]:

- June 2022: LVMH (+18% versus +25% for the FTSE All-Share, current position 1.1%)

- June 2022: Games Workshop (+78% versus +25% for the FTSE All-Share, current position 2.9%)

- June 2022: Diploma (+106% versus +25% for the FTSE All-Share, current position 1.1%)

- June 2022: Experian(68% versus +25% for the FTSE All-Share, current holding 4.9%)

- July 2022: Integrafin (+45% versus +19% for the FTSE All-Share, current position 1.9%)

- October 2022: Halma (+26% versus +25% for the FTSE All-Share, current position 2.0%)

- July 2023: Spirax Group (-31% versus +13% for the FTSE All-Share, current position 1.3%)

- May 2024: CME Group (+3% versus +1% for the FTSE All-Share, current position 1.5%)

These changes have been helpful for fund performance overall, but we’ll focus on Spirax Group here, as it has not been a successful investment over its first year in the fund.

Cheltenham-based Spirax is a quality engineering franchise with a 136-year history and 55 years of consecutive dividend growth. It is the global leader in steam and electric systems used to transfer heat and energy into industrial processes. Spirax sells low cost but high value products, via a direct sales force of highly trained engineers that have been cultivating relationships with customers for over 40 years.

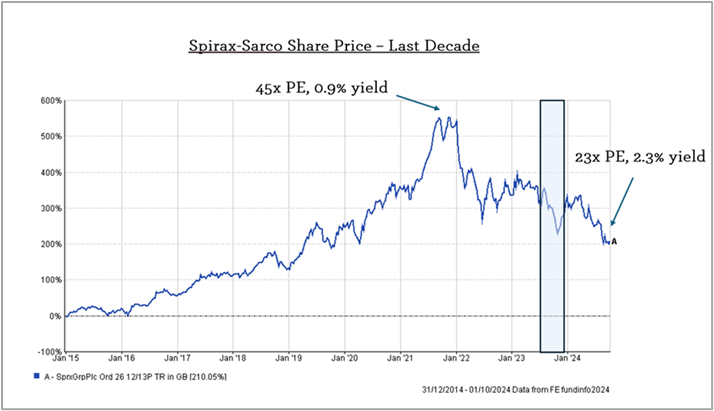

The company has compounded at a good rate over time, but as the chart below shows, its shares have been on a disorientating round trip over the last decade. As well as good fundamental performance, the stock probably also benefited, during the 2015-2021 period, from very low interest rates, and from the inflows into ESG funds at the time (the company is rated very highly for sustainability, with many of its products playing a key role in improving energy efficiency and decarbonisation). In 2021, the company’s Watson-Marlow peristaltic pump division also saw incredibly strong post-Covid demand from its biopharmaceutical customers.

At the end of 2021, Spirax was trading on a price-to-earnings (PE) ratio[v] of 45x and a dividend yield[vi] of 0.9%. Its share price has subsequently fallen -56% from this peak. The fall mainly reflects a significant valuation de-rating – the PE ratio is now 23x, and the dividend yield is 2.3%[vii]. The company has also faced some operational headwinds – from both Covid-related destocking at Watson-Marlow’s biopharmaceutical customers, and the global downturn in industrial production demand over the last two years.

Having built up an initial position in the July-October 2023 period (as highlighted in the chart), we have continued to top up the holding this year and have headroom to build further into the position. The company returned to organic growth in the first half, and we think the medium and long-term outlook looks strong. The need for investment in the world’s industrial infrastructure is significant, and augmented by the structural trends of energy efficiency, electrification and decarbonisation. Spirax’s product portfolio, technical sales force and customer embeddedness put the company in a good position to harness this growth opportunity.

The current portfolio contains a variety of high-quality UK-listed holdings that – like Diageo and Spirax – look unusually attractive relative to their long-term free cash flow compounding potential. We also have an interesting watchlist of companies that are asking the question regarding portfolio inclusion, due to similar quality and long-term value considerations. We look forward to keeping you updated.

Hugh, Chris M., Ben P., Charlotte, Leon and the Evenlode team

1 October 2024